Financial planning is mostly used by business professionals. It helps in planning and fulfilling the needs of the business. By using Financial tools and templates also helps in managing expenditure and budget.

The process of expense planning includes the estimation and calculating the expected and actual expenses. This planning tool also aids in determining and meeting market requirements and competition. Plus Income Statement is important as well to manage your business expenses

Furthermore, financial management covers the expenses of financing and assets. The planning keeps you up to date and keeps an eye on the inflow and outflow of your money. The budget can be in good control by using a Financing plan.

Financial planning is an administration means by which income and expenses are managed. By this tool, you can also refrain from unexpected and extra expenses and debt.

You can also get benefit from our article about Market Opportunity Analysis Template

Table of Contents

Key Elements of Financial Planning Spreadsheet:

A financial plan is crucial for all businesses whether small or big. The finance planning excel sheet is used for making money-related decisions. The following benefits come along with planning.

The planning helps in making good decisions about business and money in and out. Moreover, the main thing we should keep in mind is the total assets of the company and the expenditure.

Furthermore, the most promising things we should look at our long- and short-term planning.

Related Reading: Production Capacity Planning Spreadsheet

So, the Financial Planning Excel Spreadsheet includes company money structure, resources, and the expected and actual expenses. Similarly, it involves financial judgments of responsibility to manage money.

The financial plan spreadsheet aids the initiate to form the financial strategies for money management.

The main objective of the entire exercise is to guarantee the proper flow of money. And is to ensure the optimal consumption of the firm’s economic funds to get the supreme benefit.

Steps involved in Financial Planning

Planning is one of the most important factors when it comes to money especially in business. If you are saving, investing, or purchasing the planning of finances gives you lots of benefits.

Related article: Daily Expense Budget Spreadsheet Excel

Financial Planning often includes the following steps:

- Regulate Your Present Economic Position

- Build Your Business Objectives

- Pinpoint Your Opportunities

- Assess Your Substitutes

- Establish and Operate Your Business Ground Plan

- Analysis and Modify Your Strategy

Benefits of using FP Spreadsheet

Financial planning is the key to save spend and invest money easily and safely. As we all know everyone wants to manage and spend their money in a proper way. This can only be done by using an effective Budget Planning tool.

The Accounts Payable Aging Report Excel Template also benefits you in managing your business.

Money is one of the important things in life and without planning you can not manage it. You can achieve your goals by planning your finances properly. You can accomplish your saving goals by planning to save your money.

Planning is equally important whether for are managing your personal expenses or business-related expenses.

Following are some important and most crucial benefits of planning money:

- Planning makes sure of your financial security.

- It helps to accomplish your goals.

- Less possibility of going into debt.

- You can help others by saving some amount of your income.

Types of Financial Planning Excel Spreadsheet

As by far, we know the impotence and benefits of planning your money. Now here are some examples:

College Student Budget Plan Excel

As we all know student life is full of challenges. Managing is the key to success. Everything needs planning whether it’s your studies, exams, or expenses. Student life is an exercise for the long run in life.

- This template involves the expected college-going students. This helps in managing all the students’ related expenses and costs.

- You can plan your finances weekly monthly or semester wise. This allows you to budget your money and keeps you on track to avoid overspending.

- So by using a good financial planning template you need not worry about your expenses any more.

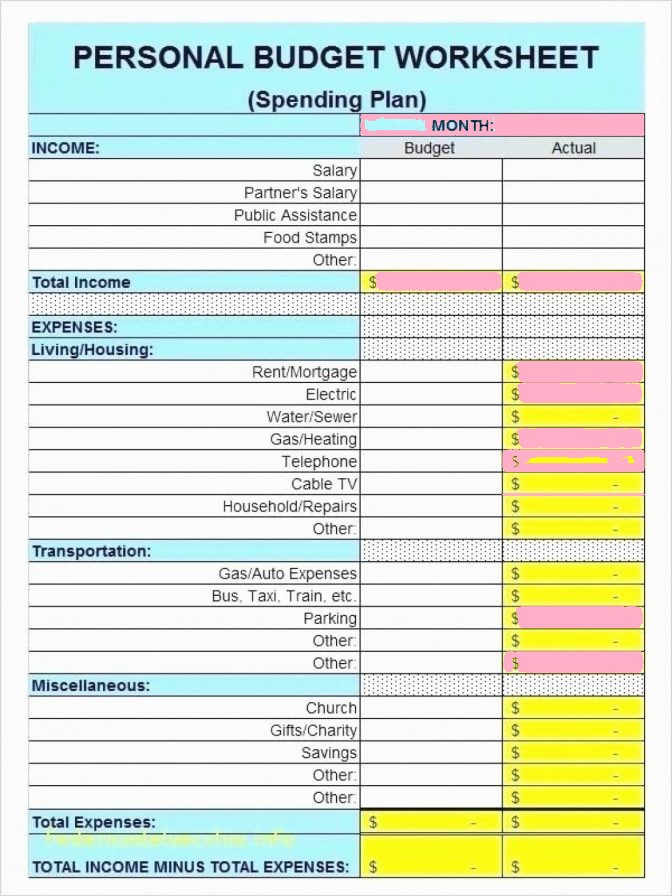

Personal Financial Planning Templates Excel

A person can also get help from a finance planning template when making decisions about personal money. All you need to know is your total income and expected expenditure.

If you plan your finances properly usually there is minimal or zero chance of going overboard. Hence planning is the key to success when it comes to money matters.

Monthly Budget Spreadsheet Excel also comes very handily when it comes to budgeting.

Event Budget Planning Template Excel

As we all know by now the significance of planning your money. Here is another important example which is even budget planning. If you are managing and organizing a conference or meeting or any other event, you must follow a proper finance plan.

When It comes to big project money management can be a challenging task. But by using a proper financial planning Spreadsheet you are safe in the money section.

References:

https://www.spreadsheetml.com/finance/financialplanningforecasting_proformafinancialstatements.shtml

https://www.excel-skills.com/excel-budget-template.php